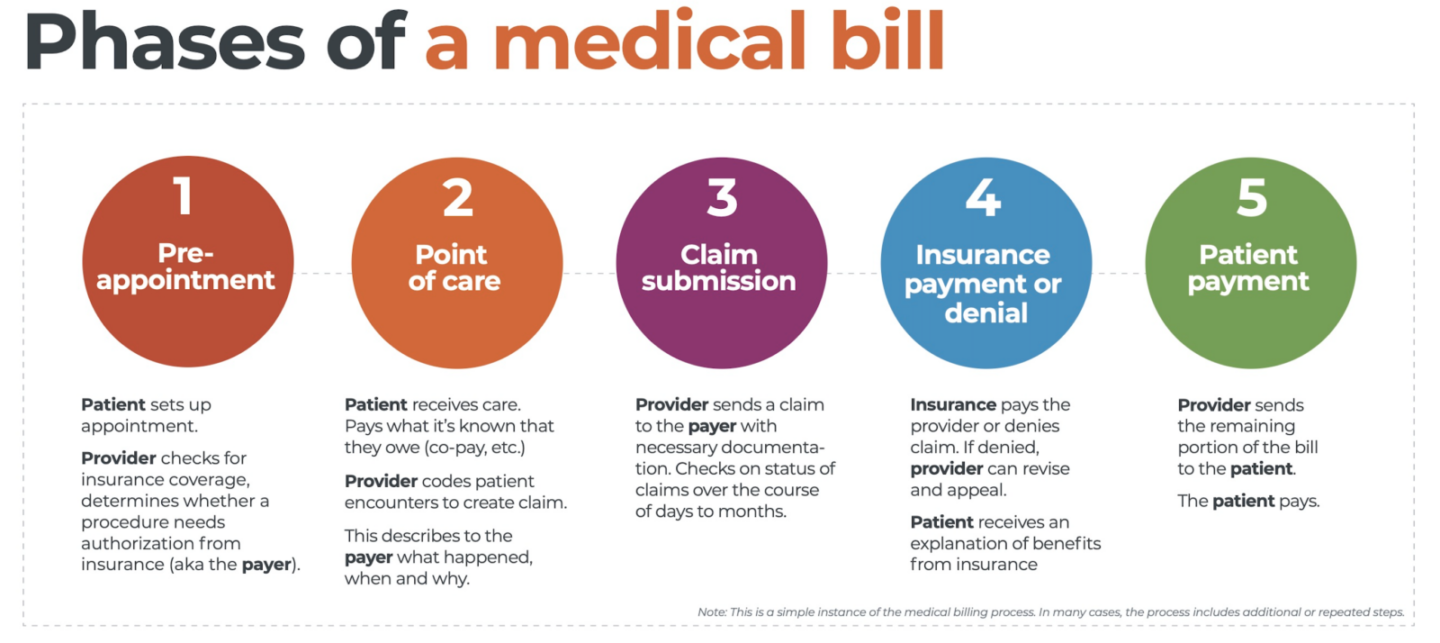

Step One: Ask Questions

Here's the deal: When you receive a medical bill, the first thing you should do is ask for an itemized breakdown. Why? Because it's not uncommon for patients to be completely in the dark about what they're actually being charged for. As Erin Fuse Brown, a health law professor at Georgia State University, puts it, "An itemized bill is a great starting point. It allows you to spot errors, like being charged for a test you never even had." Believe it or not, studies show that a whopping 80% of medical bills contain mistakes. That’s a lot of room for savings if you just take the time to review your bill carefully.

Step Two: Negotiate Like a Pro

Now here's a little-known fact that could save you big bucks: You can negotiate your medical bills. Yes, you heard me right—negotiate. The United Way suggests laying out your case clearly when you call the billing department. For instance, if you don’t have health insurance, explain that and ask for a discount. "Don't be afraid to ask for help," they say. "Financial counselors at hospitals and clinics are there to assist you in finding the best options." Whether it's a reduced rate or a payment plan, don’t hesitate to pick up the phone and make the call. You might be surprised by how willing they are to work with you.

Step Three: Plan Ahead

Let’s face it: Medical bills can be overwhelming. But there’s good news. Some medical providers offer payment plans that break down those big bills into manageable chunks over time. According to Capital One, "If you’re on a limited income, you might even qualify for an interest-free plan tailored to your needs." This means you can pay off your bill without the added stress of high-interest charges. It's all about finding a solution that works for you and your wallet.

Read also:Donnie Wahlbergs Boston Blue Teases Exciting New Chapter In The Blue Bloods Universe

Step Four: Save Smart

Here’s another tip: Consider setting up a Health Savings Account (HSA). The U.S. Department of Health and Human Services explains that an HSA allows you to set aside money on a pre-tax basis, which can then be used to pay for qualified medical expenses. "By using untaxed dollars in your HSA, you can significantly lower your overall healthcare costs," they say. This includes things like deductibles, co-payments, and other out-of-pocket expenses. It’s a smart move that could save you a ton of money in the long run.

Step Five: Prevent Problems Before They Start

Let’s talk prevention. As the old saying goes, "An ounce of prevention is worth a pound of cure." Or, in this case, a pound of medical bills. The University of Nebraska Medical Center emphasizes the importance of regular checkups and screenings for conditions like high blood pressure, cholesterol, and cancer. "The goal is to catch and treat these common conditions early, when outcomes are better and treatments are often less expensive," they explain. Taking care of your health now can save you a lot of money—and hassle—down the road.